Helping mortgage professionals achieve their clients’ purchase and investment goals, Acra Lending was formed to specialize in alternative income products, such as bank statements, asset depletion and verification of employment programs. Our programs have been developed over years to include fixed and adjustable rate mortgages (ARMs) for residential properties on both an owner-occupied and non-owned occupied basis.

Our Story

Licensed by the National Mortgage Licensing System (NMLS) and operating in 39 states and DC nationwide, we offer our programs and services through four distinct verticals: Wholesale Lending, Consumer Direct Lending, Investor Lending, and Correspondent Lending. Throughout the mortgage industry, Acra Lending is widely known for responsible lending practices, product innovation and operational efficiency.

Our Mission

The foundation of the company is built on “helping our customers” by providing Non-QM mortgage solutions for today’s borrower in residential and commercial properties across America. We provide industry leading programs to meet the needs of our customers while proving the optimal customer service experience

Our Team

The leadership team at Acra Lending is a group of highly-experienced and dedicated senior managers with an average of 25 years’ experience in Non-QM mortgage origination, underwriting and servicing.

Shawn Stone

Kyle Gunderlock

Gregory Meola

Ellen Coleman

Suzy Lindblom

Brian Jones

Andrew Hess

Trudy Barton

State Licensing Information

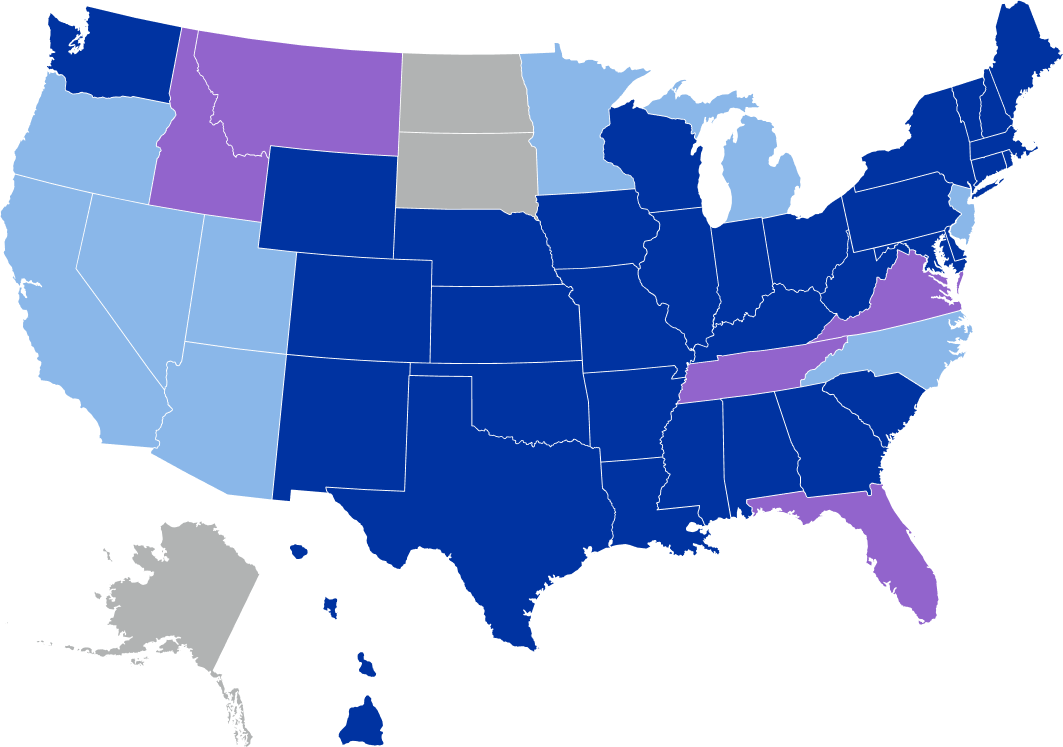

BUSINESS PURPOSE LOANS

Wholesale Lending

- Acra will work with Licensed & Unlicensed Brokers

- Acra will work with Licensed Brokers Only

- Acra Does Not Lend in These States

- Acra will lend subject to Special Broker Licensing Rules

Broker License Required If:

- Borrower is natural person, and loan is secured by residential 1-4 dwelling (MT and VA)

- Loan is secured by residential 1-4 dwelling, regardless of whether borrower is a natural person or an entity (ID)

- Broker may require a TN Industrial Loan & Thrift Registration, if not otherwise licensed in state (TN)

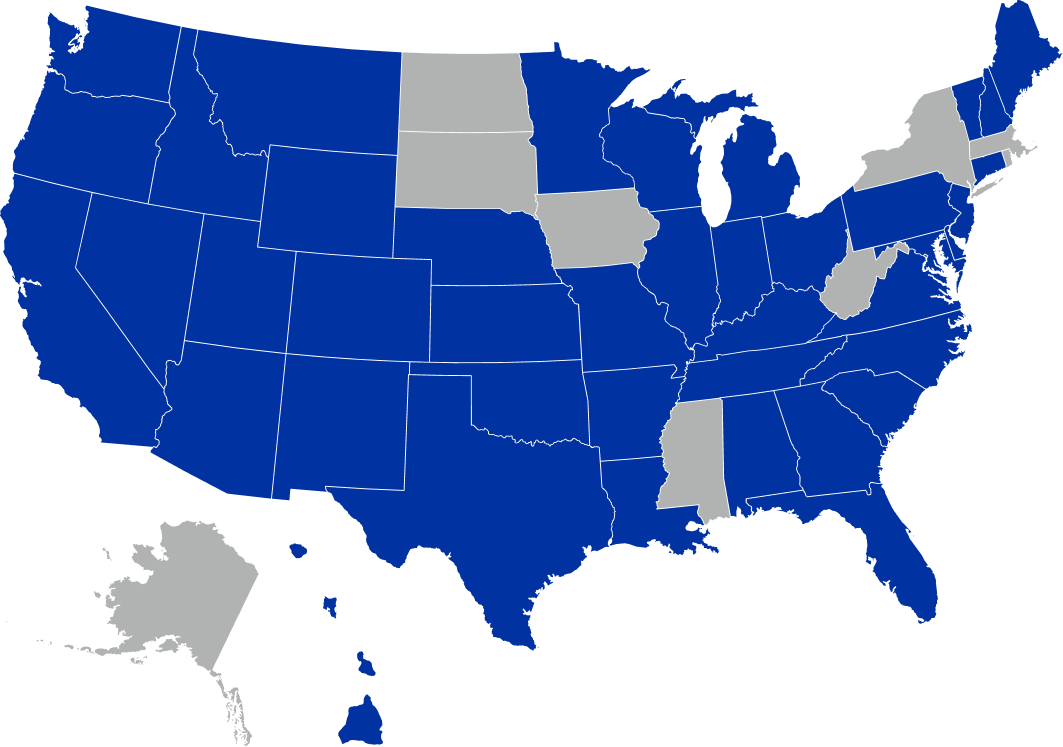

CONSUMER PURPOSE LOANS

Consumer Direct Lending

- Acra lends directly to investors in all states and D.C., except AK, ND, SD

- Acra lends directly to Consumers for 1-4 residential purposes (primary residence or 2nd home)

- Acra does not lend directly to Consumers for 1-4 residential purposes (primary residence or 2nd home)

LICENSES

Alabama

- Alabama Consumer Credit License #22078

Arizona

- Escrow Agent Lic #1008770

- Collection Agency Lic #1008769

- Mortgage Banker Lic #1034431

- Mortgage Banker OTN #1 Lic # 1034434

Arkansas

- Mortgage Banker-Broker-Servicer Lic. # 109106

- Collection Agency Lic. # AC 6624

California

- CRMLA Lic. # 41DBO-74196

- Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act.

- CFL Lic. # 60DBO-94450

- DRE Lic # 01799059

Colorado

- Mortgage Company Registration (No #)

- Regulated by the Colorado Division of Real Estate.

Connecticut

- Mortgage Lender Lic. # ML-144549

Delaware

- Lender Lic. # 020322

D.C.

- Mortgage Lender Lic. # MLB144549

Florida

- Mortgage Lender Servicer Lic. # MLD523

Georgia

- Mortgage Lender Lic./Registration # 23462

Hawaii

- Mortgage Loan Originator Company Lic. # HI-144549

- Mortgage Servicer Lic. # MS300

- Citadel Servicing Corporation dba Acra Lending is licensed in Hawaii as both a Mortgage Loan Originator Company (Lic. # HI-144549) and Mortgage Servicer (Lic. # MS300). Consumers wishing to contact the Hawaii Division of Financial Institutions or file a complaint against a mortgage loan origination company or mortgage servicer can reach the Division using the following methods. Via mail: Department of Commerce and Consumer Affairs, Division of Financial Institutions, P.O. Box 2054, Honolulu, HI 96805. Via in person or courier: Department of Commerce and Consumer Affairs, Division of Financial Institutions, 335 Merchant Street, Room 221; Honolulu, HI 96813. Via email: [email protected]. Via telephone: 808-586-2820.

Illinois

- Residential Mortgage Lic. # MB.6761204

- Licensed by Illinois Department of Financial and Professional Regulation, 100 West Randolph, 9th Floor, Chicago, IL 60601, Phone 888-473-4858.

Indiana

- Mortgage Lender Lic. # 30531

Kansas

- Mortgage Company Lic. # MC.0025274

Kentucky

- Mortgage Company Lic. # MC327787

Louisiana

- Residential Mortgage Lending Lic. (No #)

- Collection Agency / Debt Collection Registration (No #)

- Collection Agency/Debt Collection Registration

Maine

- Supervised Lender Lic. # 144549

Maryland

- Mortgage Lender Lic. # 144549

Michigan

- 1st Mortgage Broker/Lender/Servicer Lic. # FL0020685

Minnesota

- Residential Mortgage Originator Lic. # MN-MO-144549

- Residential Mortgage Originator Lic. OTN #1 Lic. # MN-MO-144549.1

Missouri

- Mortgage Company Lic. # 21-2557-S

Montana

- Mortgage Lender Lic. # 144549

- Mortgage Servicer Lic. # 144549

Nebraska

- Mortgage Banker Lic. (No #)

Nevada

- Mortgage Company Lic. # 4449

- Supplemental Mortgage Servicer Lic. # 4414

New Hampshire

- Mortgage Lender License 144549MB

New Jersey

- Residential Mortgage Lender Lic. (No #)

- Licensed by the NJ Department of Banking and Insurance.

- RMLA-Licensed Mortgage Servicer Registration (No #)

New Mexico

- Mortgage Loan Company Lic. (No #)

New York

- City of Buffalo Collection Agency Lic. #CAG24-10065489

- City of Buffalo Collection Agency Lic. # CAG24-10065489

North Carolina

- Mortgage Lender Lic. # L-160722

Ohio

- RMLA Certificate of Registration # RM.804651.000

Oklahoma

- Mortgage Lender Lic. # ML012744

- Mortgage Lender Lic.-OTN #1 – Lic. # ML013105

Oregon

- Mortgage Lender Lic. # ML-5599

- Mortgage Servicer Lic. #144549

Pennsylvania

- Mortgage Lender Lic. # 51804

- Licensed by the Pennsylvania Department of Banking.

- Mortgage Servicer Lic. # 67747

South Carolina

- Mortgage Lender/Servicer Lic. # MLS – 144549

- Mortgage Lender/Servicer Lic.-OTN #1 Lic # MLS – 144549 OTN #1

Tennessee

- Mortgage Lic. # 125315

Texas

- Mortgage Company Lic. (No #)

- Residential Mortgage Loan Servicer Registration (No #)

- Consumers wishing to file a complaint against a company or a residential mortgage loan originator should complete and send a complaint form to the Texas department of savings and mortgage lending, 2601 North Lamar, Suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov. A toll-free consumer hotline is available at (877) 276-5550. The department maintains a recovery fund to make payments of certain actual out-of-pocket damages sustained by borrowers caused by acts of licensed residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov.

Utah

- Residential First Mortgage Notification # UDFI-RFMN2015

- Mortgage Entity Lic. # 6573920

- Mortgage Entity Lic. – OTN #1 Lic. # 12074249

Vermont

- Lender Lic. # 6926

- Lender Lic.-OTN # 7601

- Loan Servicer Lic. # 144549-1

- Loan Servicer Lic.-OTN #1 Lic. # 144549-2

Virginia

- Lender Lic. # MC-5845

Washington

- Consumer Loan Company Lic. # CL-144549

Wisconsin

- Mortgage Banker Lic. # 144549BA

Wyoming

- Consumer Lender Lic. # CL-3577

- Mortgage Lender/Broker Lic. # 3781