This past week interest rates improved from the highest levels of the year in response to inflation data. Let’s talk about what happened and review what to watch in the week ahead.

“My, my, my, I’m so happy, I’m gonna join the band. We’ gonna dance and sing in celebration, We are in the promised land” – Celebration Day by Led Zeppelin.

Consumer Prices Lower Than Expected

The Federal Reserve has a dual mandate given to them by Congress:

- To promote maximum employment

- Maintain price stability

This past week, the markets directed their attention towards the price stability (inflation) portion of the Fed’s mandate. Important inflation readings at the producer and consumer level were reported. Overall, inflation came in lower than expected as prices disinflated from November to December. That is welcome news.

The Core CPI (Consumer Price Index), which excludes food and energy and is more closely watched by the markets, showed a surprising decline. Heading into the release, the markets had been on edge due to fears of inflation re-accelerating. So, as the title of this week’s newsletter states, the market experienced “jubilation” upon lower inflation.

It is important to note that this is one inflation reading, and the economy is not out of the woods as it relates to higher or sticky inflation. Additionally, this reading is from December, so it is backward-looking. Since that time, oil prices have spiked sharply, now standing at nearly $80 a barrel. This means it would not be a surprise to see headline inflation creep higher or not come down in next month’s reading.

A positive sign within the report that could bode well for inflation in the future is shelter. Shelter makes up an outsized portion of consumer price inflation, and that number has retreated. If that trend continues, it will help inflation ease back down to the Fed’s goal of 2% over time.

The Fed’s more favored gauge of inflation, the Core Personal Consumption Expenditure (PCE) index, will be reported in a couple of weeks. This reading runs lower than CPI as it has a different methodology. Here’s what the Cleveland Fed has shared on the differences between CPI and PCE.

“Different weights: Weights reflect the proportion of consumers’ total spending on an item. Many weights in the CPI and PCE price index are similar, such as those for food. But many other weights are different.

Two big differences are for healthcare and shelter. Because the PCE price index includes third-party payments for healthcare made on behalf of households, the PCE weight for that item is higher compared to in the CPI. On the other hand, the larger number of goods and services in the PCE price index means that housing has a lower weight compared to in the CPI.”

PCE is made up of 16% healthcare and 16% housing.

CPI is made up of 4% healthcare and 32% housing.

If future inflation readings come in lower still, we could see the Federal Reserve cut rates this year more than the one cut currently expected.

30-yr Mortgage Rates

The 30-year fixed rate mortgage averaged 7.04% as of January 16, 2025, up from the previous week when it averaged 6.93%. A year ago at this time it was 6.60%.

10-year Note yield 4.65%

The 10-yr Note yield, which ebbs and flows with mortgage rates, declined nicely from the 2024 highs above 4.80% – backing down to the 4.65% level. The 4.65% has provided some “yield resistance” as rates were rising, so that will be “yield support” potentially slowing the improvement in rates.

Bottom Line: The previous two times rates were at these levels, they improved nicely. The softer inflation numbers may have been the spark to help rates improve this time around as well.

Looking Ahead

We are now in the Fed’s blackout or “quiet period” where no Fed officials comment or speak about Monetary policy until Friday January 31st – two days after the next Fed Meeting. We will also see President-elect Trump be sworn in as our 47th President on Monday. The week is shortened as we observe Martin Luther King Jr. Day on Monday Jan 20th. The week’s economic calendar is very light. Watching key levels and charts in the absence of news is important.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices (big green candles) have jumped higher – this in response to lower inflation news.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, January 17, 2025)

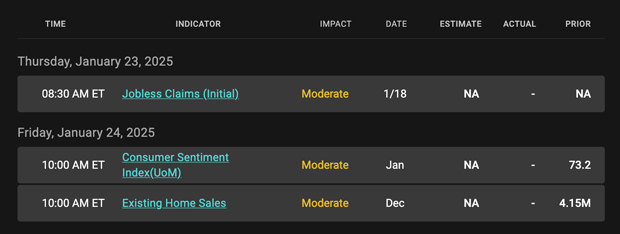

Economic Calendar for the Week of January 20 – 24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.