Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

After a week of historic volatility, the financial markets and interest rates experienced a calmer period. Let’s review last week’s events and preview what’s ahead.

Dimon/Fed Put Calms Markets

On Friday, April 11, calming words from JPMorgan Chase CEO Jamie Dimon and Boston Fed President Susan Collins helped stabilize the bond markets. During a week when Treasury rates spiked at their fastest pace in 43 years, Dimon suggested that if the bond market “kerfuffle” persists, the Federal Reserve would step in to stabilize it. Hours later, Collins reinforced this, stating the Fed is prepared to act if bond market instability continues.

The notion that the Fed would intervene, as it did during the volatile early days of the pandemic, brought temporary calm. That stability has extended into this week, with long-term Treasury yields and mortgage rates improving from their recent peaks.

Treasury Secretary Scott Bessent’s Soothing Words

It wasn’t just Dimon and Fed officials offering reassurance. Treasury Secretary Scott Bessent also provided comforting guidance to the markets.

“We have a robust toolkit, including buybacks, and the Federal Reserve holds Treasuries at a certain level. If the Fed believed a foreign rival was weaponizing the U.S. government bond market or attempting to destabilize it for political gain, we would act together. But we haven’t seen that,” Bessent said.

While uncertainty surrounds tariff negotiations and their potential impact on the economy and interest rates, reassurances from both the Fed and Treasury about their readiness to ensure stability have contributed to this week’s relative market calm.

Hard Data Still Solid

Soft data, such as Consumer Sentiment surveys, has been weak recently due to prevailing uncertainty. However, hard data including inflation readings, jobs reports, and GDP remains solid. This week’s strong Retail Sales report further confirmed that consumer spending is holding up, at least for now.

The key question is whether weak soft data will eventually translate into weaker hard data. If it does, the Fed may face pressure to cut rates sooner and more frequently.

Fed Quiet Period

Starting at midnight on Friday, Fed officials will enter a quiet period ahead of the May 2nd meeting: refraining from public comments. It’s encouraging that Fed leaders addressed recent volatility and reassured markets of their readiness to act if needed.

30-Year Mortgage Rates

The 30-year FRM averaged 6.83% as of April 17, 2025, up from the previous week when it averaged 6.62%.

4.35%

After peaking at 4.60% last week, the 10-year Treasury yield fell below 4.50% to 4.35%. As noted in prior newsletters, sustained movement below 4.20% and ideally 4.00% is needed for significant rate relief, which hasn’t occurred in some time.

Bottom Line: Interest rates and financial markets remain influenced by tariff uncertainty. Clearer signals on tariff outcomes will provide a better picture of rate trends. For now, the Fed and Treasury’s commitment to intervene if necessary is helping to prevent further rate spikes.

Looking Ahead

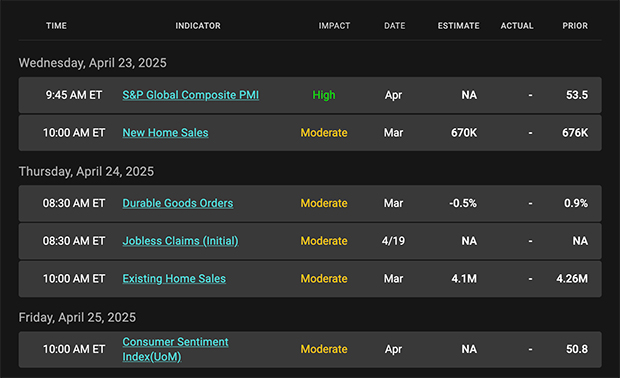

Next week features a lighter economic calendar with a few moderately impactful reports. Several Treasury auctions are scheduled and strong demand, particularly from foreign buyers, as seen in recent auctions, will be critical. Real-time tariff-related headlines will also require close attention.

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are paramount, and they’re tied to mortgage bond prices. The chart below tracks the Fannie Mae 30-year 6.0% coupon. The rule is simple: rising bond prices mean falling mortgage rates; falling prices mean rising rates. On the right side of the chart, bond prices have rebounded nicely, contributing to improved mortgage rates.

Chart: Fannie Mae 30-Year 6% Coupon (Friday, April 18, 2025)

Economic Calendar for the Week of April 20-24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.