Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

Let’s discuss what happened and peek into the week ahead.

U.S. and China

Likely the biggest news, related to tariff negotiations, is that the U.S. and China have agreed to a 90-day pause to work out details for a longer-term trade policy that equally benefits both parties. The pause and the shelving of high tariffs sparked a “risk-on” rally, where money flowed into riskier assets like stocks, cryptocurrencies, and oil. As this happened, money moved out of safe assets like government bonds and Treasury debt, leading to the uptick in interest rates here at home.

Conflict Resolution

India and Pakistan agreed to a ceasefire, which is very good news, as both countries possess nuclear weaponry, and any escalation would be very bad news.

Potentially even bigger news regarding conflict resolution is that Russia and Ukraine were set to meet at press time on Thursday, May 14, to discuss long-term peace negotiations. Ending this war would benefit the people of both countries and the financial markets. The opposite is also true.

Inflation at Four-Year Low

Amid this wave of good news, there was positive news on the inflation front, with the Consumer Price Index coming in at 2.3% annually; the lowest in over four years. Normally, low inflation readings would support the bond market, but this news was overshadowed by larger developments that drove stocks higher.

Foreign Investment in the U.S.

Over the past few weeks, multiple countries and multinational companies have announced investments in the United States. This trend continued when President Trump visited Saudi Arabia and Qatar, where significant investments from both countries were announced.

Fed Cut on Hold

One reason for the uptick in interest rates this week is that this perceived good news for the U.S. economy means the Federal Reserve can delay rate cuts further. Just a couple of weeks ago, there was a chance they might cut rates in May. Now, the next rate cut is being priced in for July.

4.50%

Unfortunately, the good news pushed the 10-year note yield beyond an important technical level of 4.50%. Without a quick retreat below this key level, yields could creep higher toward levels last seen in February.

Bottom Line: A lot of uncertainty remains, but the chance of a recession has been nearly eliminated. All this good news will keep the Fed on hold as they monitor the economy and inflation.

Looking Ahead

Next week is light on economic news. Focus will remain on tariff negotiations and Fed speak. Another development gaining steam is the negotiation of a new tax bill, which is intended to extend the present tax rates into the future. How will the bond market respond to this new tax bill? Does it increase deficits? Does it grow the economy?

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are critical and closely tied to mortgage bond prices. The chart below tracks the Fannie Mae 30-year 6.0% coupon. The rule is straightforward: rising bond prices lead to lower mortgage rates, while falling prices drive rates higher. The right side of the chart shows prices have fallen back down to the lows of last month. Let’s hope prices hold at the $100.50; if they don’t, rates will move another leg higher.

Chart: Fannie Mae 30-Year 6% Coupon (Friday, May 16, 2025)

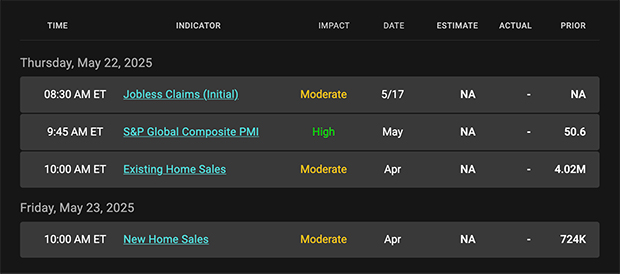

Economic Calendar for the Week of May 19-23

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.