Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

Last week the Fed held cutting rates, we witnessed a ton of good economic news and rates held steady. Let’s dive into the news and look at what to watch in the week ahead.

“Yeah hey, Alright (right now), We’ll spend the night together Wake up and live forever”. Alright by Jamiroquai

The Fed

The Federal Reserve’s July 31st statement kept rates steady at 4.25%–4.5%, with no immediate cut but hints of a possible September move if inflation keeps cooling.

The Fed’s tone suggested they’re eyeing both jobs and inflation closely. Any surprises in the forthcoming data could tilt their September plans.

For your clients: Emphasize stability for now but prep them for potential rate shifts.

Some Good Economic News: Gross Domestic Product (GDP)

GDP measures the monetary value of final goods and services of a country during a specified period. On Tuesday, the first reading (there are three readings after two revisions) of 2nd Quarter GDP came in at 3.0%. This was well above expectations of 2.6% and a big rebound from the first quarter’s -0.5% reading.

The very positive news is being taken with some grain of salt in the markets. Why? The tariff uncertainty in the 1st quarter prompted a surge in imports, on the fear prices would rise. If you import more than you export, the difference is subtracted from GDP, hence the bad 1st quarter GDP number.

In the 2nd Quarter, that trend was reversed; companies imported less, and we exported more, thereby “adding” to GDP.

Markets are likely adding the 1st and 2nd quarter GDP, dividing by 2 and moving on. At the end of the day, this is a 2nd quarter number, and the 3rd quarter already started, so this is backward-looking.

Consumers are Feeling Better

The Conference Board’s Consumer Confidence index improved nicely in July.

“Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.”

Why is this important? Consumer Spending makes up nearly 70% of our GDP. If consumers feel OK they spend and our economy grows; the opposite is true.

30-Year Mortgage Rates

The 30-year fixed rate mortgage averaged 6.72% as of July 31, 2025, down slightly from the previous week when it averaged 6.74%.

4.35%

The 10-year Treasury note yield, our mortgage rate compass, hovered around 4.35% last week, still stuck in the 4.20% – 4.50% range.

Bottom Line: The mortgage market is in a tug-of-war between inflation fears and economic slowdown signals. And rates are going to break out of its longstanding sideways range once more clarity emerges.

Looking Ahead

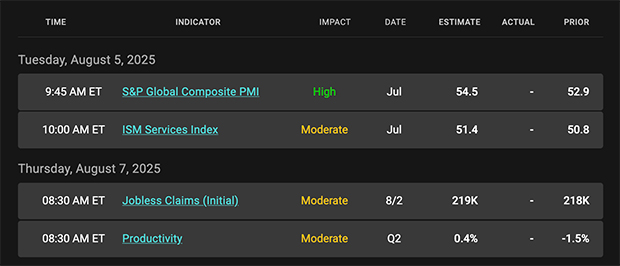

Next week, expect the dust to settle from this data-heavy period. Key reports to keep on your radar include:

- ISM Manufacturing Index: A gauge of economic activity in the industrial sector.

- Weekly Initial Jobless Claims.

Mortgage Market Guide Candlestick Chart

The chart clearly illustrates how rates remain confined within a broad range, with a ceiling limiting rate decreases and a floor capping rate increases. At some point, bonds will break out of this range, providing a clear signal for mortgage and housing professionals, as well as individuals looking to purchase or refinance a home.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, August 1, 2025)

Economic Calendar for the Week of August 4-8

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.