Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

This week, the labor market and falling interest rates were in fo

cus, with 30-year mortgage rates hitting their lowest since October 2024. Here’s what happened and what’s ahead for us.

“Ain’t no mountain high enough, Ain’t no valley low enoughAin’t no river wide enough, To keep me from gettin’ to you, baby”

Ain’t no Mountain High Enough by Marvin Gaye and Harvey Fuqua

“We do not seek or welcome further cooling in labor market conditions.” – Fed Chair Jerome Powell, Aug 23, 2025

Last week’s ADP Report showed private job creation at 54,000 for August, below the expected 73,000. This weaker-than-expected data pushed the probability of a 0.25% Fed rate cut on September 17th to 98%.

Note: Fed rate cuts don’t always lower long-term mortgage rates. For example, last September’s 0.50% cut led to a 0.60% spike in the 10-year Treasury note and mortgage rates.

JOLTS: Fewer Job Openings

The Job Openings and Labor Turnover Survey (JOLTS) reported 7.2 million job openings, slightly below the prior reading and the lowest in nearly a year. However, hiring and quit rates remained stable, offering some positive news.

Services Sector Keeps Growing

The services sector, including real estate, expanded for the third consecutive month, per the ISM Services PMI Report. The PMI hit 52% in August (up from 50.1% in July), marking expansion for the 13th time in 14 months.

Key points:

Business Activity: Strong at 55% (up from 52.6%), steady since May 2020.

New Orders: Jumped to 56% (from 50.3%), signaling rising demand.

Employment: Weak at 46.5% (slightly up from 46.4%), showing hiring challenges.

Supplier Deliveries: Slowed to 50.3% (from 51%), reflecting higher demand.

Prices: High at 69.2% (down from 69.9%), indicating persistent cost pressures.

What this means for you: The services sector, including real estate, is experiencing consistent growth driven by strong business activity and new orders. However, rising prices and slower deliveries may impact costs, while hiring challenges persist.

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.50% as of September 4, 2025, down from the previous week when it averaged 6.56%.

4.20%

The 10-year Treasury note yield, which ebbs and flows with mortgage rates has remained in a range between 4.20% and 4.50% for several months. This all changed this past week when the 10-yr dipped beneath 4.20%.

Bottom Line: Mortgage rates are at 10+ month lows and the 10-yr note yield looks poised to breakout out of its long-standing range between 4.20 and 4.50%

Looking Ahead

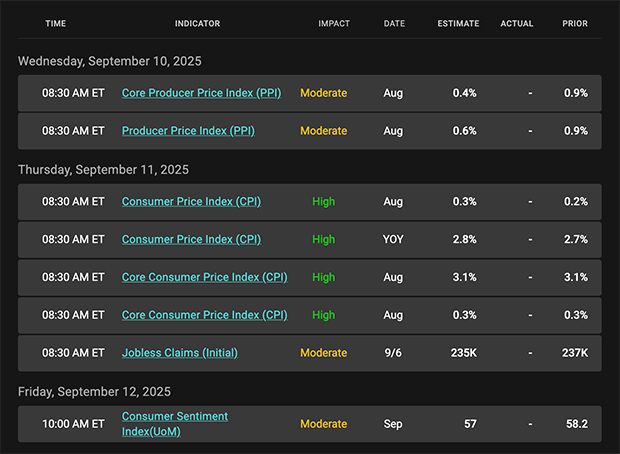

Next week, the Fed enters its pre-meeting blackout period, so no public comments are expected before September 17th.

Key events include: New Treasury debt sales (10-year notes and 30-year bonds).

August Consumer Price Index (CPI) and Producer Price Index (PPI) releases.

Mortgage Market Guide Candlestick Chart

The chart shows mortgage prices nearing 11-month highs, aligning with the lowest mortgage rates in over 11 months. The 10-year Treasury note yield is testing a breakout below 4.20%, a bullish sign for rates.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, September 5 2025)

Economic Calendar for the Week of September 8-12

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.