Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

This past week, interest rates reached their lowest levels in nearly a year, and consumers have taken notice. Let’s dive into the key developments as we approach the Federal Reserve meeting on September 17, 2025.

“Well, I feel so good, everything is getting higher. You better take it easy, cause the place is on fire” Gimme Some Lovin’ by The Spencer Davis Group

Low Rates Drive High Activity

Interest rates have been steadily declining since May, recently hitting their best levels in nearly a year. This has sparked a surge in mortgage demand, with both purchase and refinance applications on the rise.

According to the Mortgage Bankers Association: “Mortgage rates declined for the second consecutive week as Treasury yields moved lower on data indicating a weakening labor market,” said Joel Kan, MBA economist. “This spurred the strongest week of borrower demand since 2022.”

Producer Prices Cool Down

The Producer Price Index (PPI) for August 2025, released on September 10, fell by 0.1% month-over-month, down from July’s 0.9% increase. The annual PPI growth rate slowed to 2.6% from 3.1% in July, signaling cooling wholesale price pressures.

Key points:

- Services prices dropped by 0.1%.

- Goods prices rose by 0.3%, indicating mixed signals.

- This volatility could impact future business and supply chain costs.

Consumer Prices Meet Expectations

The Consumer Price Index (CPI) for August 2025, reported on September 11, rose by 0.4% month-over-month, up from July’s 0.2%, with the annual inflation rate at 2.9%. Persistent housing and energy costs continue to drive consumer price growth, a key factor for the Fed to monitor.

10-Year Treasury Note Sees Strong Demand

The U.S. Treasury’s 10-year note auction on September 10, 2025, saw robust demand, with the $39 billion sale clearing at a yield of 4.033%, below pre-auction expectations.

Highlights:

- The bid-to-cover ratio rose to 2.65, up from 2.35 last month.

- Primary dealers took a record-low 4.2% of the offering, the smallest share since 2003.

- Indirect bidders, including foreign investors, secured 83.1%, reflecting strong investor confidence in U.S. debt and a resilient bond market.

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.35% as of September 11, 2025, down from the previous week when it averaged 6.50%.

4.00% to 4.20%

The 10-year Treasury Note yield, closely tied to mortgage rates, had been stable between 4.20% and 4.50% for nearly 11 months. Recently, it dipped below 4.20%, now ranging between 4.00% and 4.20%. A further drop below 4.00% could lead to even lower mortgage rates.

Bottom Line: Mortgage rates are near one-year lows as we approach the Fed meeting on September 17.

Looking Ahead

The Federal Reserve meeting next week is the main event, with a 0.25% rate cut now seen as a 100% certainty. The focus will be on the updated Summary of Economic Projections, which includes forecasts for inflation, GDP, unemployment, and the number of rate cuts expected by the end of 2025. Previously, the Fed projected two rate cuts, but markets now anticipate three. The market’s reaction will hinge on whether the Fed maintains its forecast of two cuts or signals three.

Mortgage Market Guide Candlestick Chart

The latest candlestick chart shows mortgage prices surging to 2025 highs, poised to close at their best level in over a year. This indicates mortgage rates are nearing their lowest point in the same period.

Note: Refer to the attached candlestick chart for a visual representation of mortgage price trends.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, September 12, 2025)

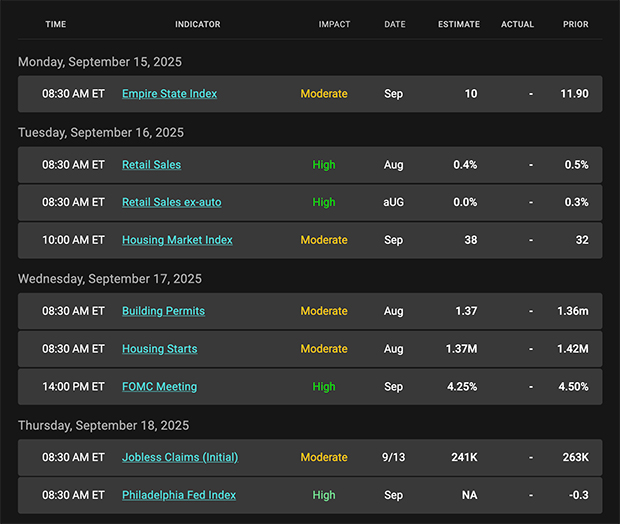

Economic Calendar for the Week of September 15-19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.