Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

This past week interest rates held steady and near the best levels of the year in the face of the Fed Minutes which were released. Let’s break down what the Fed Minutes said and what it means for rates, while taking a look at the year ahead.

Make no mistake where you are, your back’s to the corner, don’t be a fool anymore, the waiting is over. This is It…by Kenny Loggins.

The Federal Reserve’s latest meeting minutes, released on October 8, 2025, from the September 16-17 gathering, paint a picture of an economy that’s cooling off a bit but not crashing. The Fed decided to cut interest rates by a modest quarter-point, bringing the federal funds rate range of 4% to 4.25%.

This move was backed by nearly all committee members, with just one pushing for a bigger half-point slash. As the minutes note, “Almost all participants supported reducing the target range for the federal funds rate by 1/4 percentage point at this meeting.” The goal? To gently support jobs without letting prices run too hot, especially as markets are worried more about a softening job market.

On the jobs front, things are easing up without major alarms. The unemployment rate ticked up to 4.3% in August, and job growth has slowed, with big downward revisions showing hundreds of thousands fewer hires than thought. Wages are rising at a tamer 3.5 to 3.7% yearly pace. Yet, the Fed saw no sudden plunge: “Participants generally assessed that recent readings of these indicators did not show a sharp deterioration in labor market conditions.” Inflation, meanwhile, nudged higher to 2.7% for overall prices and 2.9% for core (excluding food and energy), partly blamed on new tariffs. It’s above the Fed’s 2% target but not spiraling, giving policymakers some breathing room.

Looking Ahead

The Fed folks stressed a careful, data-driven path, with risks now tilting more toward job worries than price spikes. They updated their statement to highlight “slowed job gains” and “edged-up unemployment,” signaling a pivot in focus. “Participants indicated that their outlooks for the labor market were uncertain and viewed downside risks to employment as having increased over the intermeeting period,” the minutes explain. Most expect more rate cuts this year to nudge the economy toward balance, but they’re wary of overdoing it and reigniting inflation or keeping rates too high and choking growth.

In the longer view, the Fed’s projections show brighter days: GDP growth picking up in 2026, unemployment stabilizing at low levels, and inflation easing back to 2% by 2027. They’re sticking to their dual mission of strong jobs and steady prices. As the minutes affirm, “The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.” Overall, it’s a steady-hand approach amid uncertainties like trade policies, keeping the economy on track without big surprises.

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.30% as of October 9, 2025, down from the previous week when it averaged 6.34%.

4.20%

The 10-year Treasury yield, closely tied to mortgage rates, continues to trade in a range between 4.00% and 4.20% For rates to get better, we need to see the 10-yr move beneath 4.00%

Bottom line: Mortgage rates have improved steadily all year and remain within a whisker of the best rates of 2025.

Looking Ahead

If the government remains shut down, we may see less economic reports for markets to move on. One of the releases scheduled was the Consumer Price Index; a key reading on inflation. There will be Fed speak that will continue until next Friday night when the quiet or blackout period begins.

Mortgage Market Guide Candlestick Chart

Mortgage bonds pulled back from recent highs, meaning rates edged slightly higher from their 2025 lows.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, October 10, 2025)

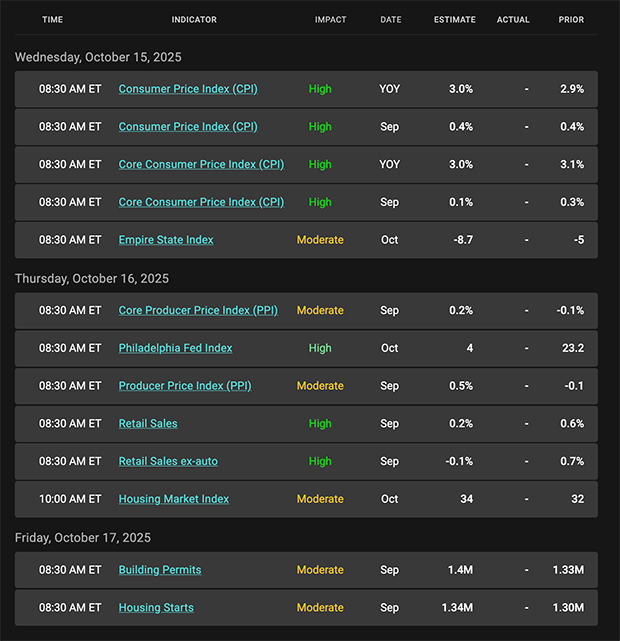

Economic Calendar for the Week of October 13-17

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.