Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

This past week, the Federal Reserve cut interest rates for the first time this year. Let’s break down what happened and preview next week’s economic calendar.

“The first cut is the deepest, baby I know the first cut is the deepest” – Rod Stewart

The Fed Monetary Policy Statement Explained

In addition to potentially making changes to the Fed Funds Rate at every meeting, the Federal Reserve also issues a Monetary Policy Statement which includes color and rationale behind the Fed’s action.

Here’s a simple breakdown of the Fed’s Statement…

The U.S. economy showed signs of slowing down in the first half of the year, with fewer new jobs being added and the unemployment rate ticking up slightly; though it remains relatively low overall. At the same time, inflation has risen and is still above comfortable levels.

The Federal Reserve, which aims for full employment and a steady 2% inflation rate in the long term, notes high uncertainty in the economic outlook and growing risks to the job market.

To address these challenges, the Fed decided to cut its key interest rate (the federal funds rate) by a quarter of a percentage point, bringing it to a range of 4% to 4.25%.

The Fed will keep watching incoming data on jobs, prices, and global events to decide on any further changes, while continuing to shrink their portfolio of government bonds and mortgage securities. The Fed remains focused on supporting jobs and getting inflation back to 2%, and it’s ready to tweak policies if new risks arise.

The Fed Press Conference

After every Fed Meeting, there is a press conference where the Fed Chair shares thoughts and answers questions from reporters. Here are the highlights from the Press Conference…

The Fed’s decision, described as a “risk management cut,” was driven by increasing concerns about a weakening labor market, with job growth slowing and unemployment edging up to 4.3%, though still low.

Powell highlighted that the Fed’s focus has shifted toward supporting employment, as downside risks to jobs have risen, while acknowledging that inflation remains above the Fed’s 2% target, partly due to tariff-related price increases. The decision saw a dissent from new Fed Governor Stephen Miran, a Trump appointee, who pushed for a larger half-point cut, reflecting some division within the committee.

Powell emphasized the uncertainty in the economic outlook, stating, “It’s not incredibly obvious what to do,” and noted that the Fed would make future decisions on a meeting-by-meeting basis, with projections suggesting two more quarter-point cuts could occur in 2025.

He downplayed concerns about political pressure from the Trump administration, asserting the Fed’s commitment to its dual mandate of price stability and maximum employment. Powell also addressed tariffs, clarifying that they are mostly paid by companies, not foreign exporters, and could gradually pass through to consumers, contributing to inflation. The Fed’s “dot plot” revealed varied opinions among officials, with some expecting no further cuts this year and others, anticipating more aggressive reductions in 2025.

The lack of consensus on the dot plot going forward means we should expect continued uncertainty and volatility in interest rates.

The Consumer is Still Spending

This week’s U.S. Retail Sales data for August 2025 showed a solid increase, up 0.6% from July 2025 and 5.0% higher than August 2024, according to the Census Bureau; this was also well above expectations.

Key sectors driving growth included auto dealerships (up 0.5%), clothing stores (up 1.0%), online sales (up 2.0%), and food services and drinking places (up 0.7%), reflecting resilient consumer spending despite economic headwinds like a softening labor market and tariff-related price pressures.

Core retail sales, which exclude volatile categories like autos and gas, rose 0.7%, signaling strong underlying demand.

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.26% as of September 18, 2025, down from the previous week when it averaged 6.35%.

4.00% to 4.20%

The 10-year Treasury note yield, closely tied to mortgage rates, had been stable between 4.20% and 4.50% for nearly 11 months. Recently, it dipped below 4.20%, now ranging between 4.00% and 4.20%.

Bottom Line: The bond market reaction to the Fed rate cut and Statement now appears to be a very much “buy on the rumor and sell on the news” with bonds being sold and rates climbing after the Fed cut was announced.

Looking Ahead

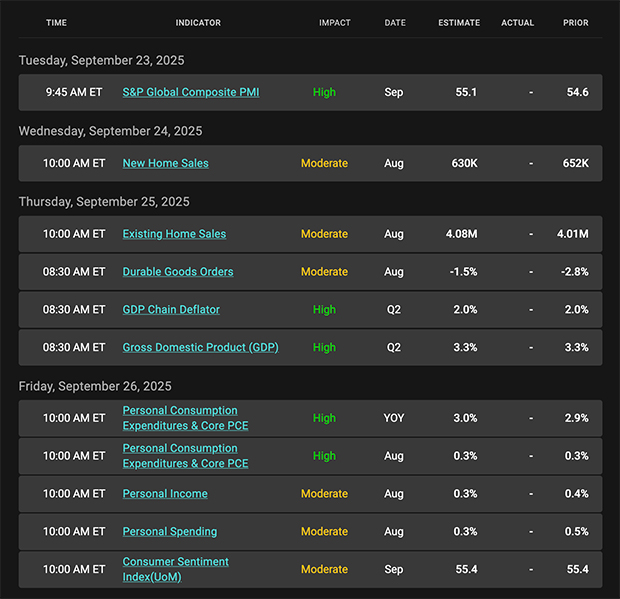

On the heels of the Fed Meeting, markets will be back to watching the economic news and there is no shortage of that next week. The main event will be the Fed’s favored gauge of inflation and the reading they want at 2.00% is the Core Personal Consumption Expenditure Index (PCE). Consensus estimates suggest the reading will be reported at 3.00% year over year; still well above the Fed’s goal of 2.00%.

There will also be readings on housing, consumer spending by way of Durable orders and GDP which could move the markets. Lastly there will be Treasury auctions and plenty of Fed speak to navigate.

Mortgage Market Guide Candlestick Chart

The latest candlestick chart shows mortgage pulling back from 2025 prices which means rates increased slightly from 2025 lows.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, September 19, 2025)

Economic Calendar for the Week of September 22-26

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.