Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

What a week it’s been! The economy has been throwing us some curveballs, but there’s also some good news to chew on. Interest rates are looking a bit friendlier, hitting their best levels in nearly a month. Still, it’s not all smooth sailing. Let’s unpack what happened and what it might mean for the week ahead.

“Any further cooling in the labor market would be welcome.” – Jerome Powell

Labor Market Woes

Tuesday brought some rough news. The ADP report, which tracks private-sector job creation, showed a measly 37,000 jobs added in May; way below the 110,000 analysts were expecting (ADP Employment Change).

This was “unwelcome” news, to quote Powell, since job growth fuels consumer spending. Adding to the uncertainty, Initial Jobless Claims were reported at the highest levels in four years; meaning people are filing for unemployment at the highest rate in four years.

On top of this, the Institute for Supply Management (ISM) Services PMI slipped to 49.9, down from 51.6 in April, signaling contraction for the first time since June 2024 (ISM Services PMI). Since services make up most of our economy, this is a red flag to follow. If this trend continues, it could drag economic growth down.

Bond Market Bright Spot

Here’s where things get a bit cheerier. The bond market decided to throw a party, with prices climbing and yields dropping. The 10-year Treasury note yield fell below 4.40% for the first time in weeks, which is a welcome development. Lower yields mean borrowing costs ease up, including mortgage rate relief.

Europe’s Moving Fast

Over in Europe, the European Central Bank (ECB) is making moves, cutting its deposit facility rate by 25 basis points to 2.25% in April (ECB Monetary Policy). Why? Their inflation rate is under control, hovering below their 2% target. Meanwhile, the U.S. Federal Reserve is playing it cautious, and for good reason. Back in 2020, we went big with stimulus checks and bond-buying programs, which kept inflation stickier here than in most places. Think higher-for-longer inflation means higher-for-longer rates.

Growth on the Horizon?

Now for some potentially good news. The Atlanta Fed’s GDPNow model estimates a solid 4.6% growth for Q2 2025, a huge turnaround from the -0.3% contraction in Q1. Before you get too excited, though, keep in mind this number is likely to be revised and maybe even sharply lower. Still, it’s a sign that recession fears might be a tad overblown right now. The model pulls together real-time data from 13 GDP components, so it’s a decent snapshot, but it’s not set in stone.

30-Year Mortgage Rates

The 30-year fixed rate mortgage averaged 6.85% as of June 5, 2025, down from the previous week when it averaged 6.89%.

10-Year Note

As mentioned above, it was welcome news to see the 10-year note yield decline below 4.40%. Now we’re watching to see if the 10-year can revisit and potentially close below 4.20%, which it has been unable to do consistently for a very long time.

Bottom Line: We’re in a bit of a tug-of-war: lower interest rates and a promising growth outlook on one side, but a shaky labor market and a contracting services sector on the other. Uncertainty remains high, but for now, the economy continues to show resilience.

Looking Ahead

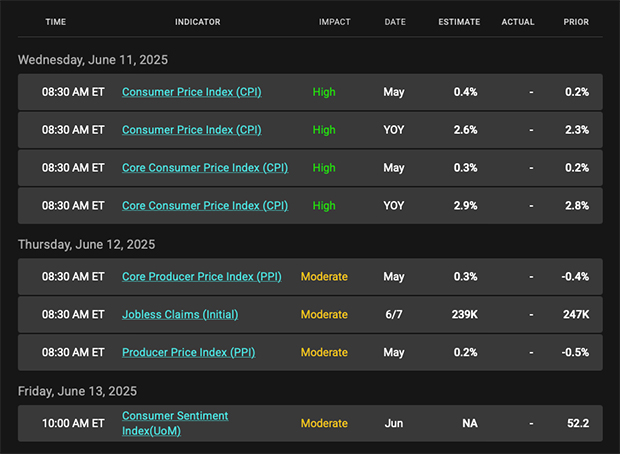

Next week is filled with headline risk as we await the important Consumer Price Index (CPI). The inflation rate has been cooling or disinflating, which is a welcome sign. It will also be a big week for Treasury auctions as the department sells billions of dollars in long-term notes and bonds. These are important to track because if the buying appetite is weak, rates tick higher. The opposite is true.

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are critical and closely tied to mortgage bond prices. The chart below tracks the Fannie Mae 30-year 6.0% coupon. The rule is straightforward: rising bond prices lead to lower mortgage rates, while falling prices drive rates higher. The right side of the chart shows prices have bounced sharply higher (big green candle), leading to the best prices/rates in one month. We are approaching a ceiling of resistance at $101.50, which has capped any further rate improvement for the past eight months!

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, June 6, 2025)

Economic Calendar for the Week of June 9 – 13

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.