Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

Last week, mortgage rates dipped despite mixed inflation news, and all eyes are now on the Jackson Hole Symposium. Let’s break down what happened and what to watch next week.

“We’re going to Jackson – going to mess around” – Johnny Cash

Credibility

“What will you do with tariff revenue?” – Bloomberg News

“Pay down the national debt” – Treasury Secretary Scott Bessent

The bond market loves this kind of talk about tackling the $37 trillion U.S. debt and high deficits. Lower deficits could push long-term rates, like the 10-year Treasury, down, which helps keep mortgage rates low. Bessent also hinted at a possible 0.50% Fed rate cut soon, but the market isn’t fully betting on it yet.

Key Point: Fed rate cuts don’t always mean lower mortgage rates. Last September’s 0.50% cut actually stopped mortgage rates from falling further. Markets look ahead, so we might see rates rise after a cut is confirmed.

Mixed Inflation News

Tuesday’s Consumer Price Index (CPI): Inflation dropped to 2.7% year-over-year, better than expected, thanks to low oil prices (~$63/barrel). This boosted the odds of a Fed rate cut in September to nearly 100%.

Thursday’s Producer Price Index (PPI): This came in hotter than expected, showing higher costs for producers. This could mean higher consumer prices later, but the bond market barely reacted.

Why It Matters: CPI shows inflation cooling, which is good for rates. But hot PPI signals potential future price hikes, so markets are cautious.

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.58% as of August 14, 2025, down from the previous week when it averaged 6.63%.

4.20%

The 10-year Treasury Note yield, which guides mortgage rates, is near the low end of its 4.20%-4.50% range.

Bottom Line: Mortgage rates are at a 10-month low, but the Jackson Hole Symposium could spark the next big move.

Looking Ahead

Next week, the Jackson Hole Symposium in Wyoming brings together global central bankers. Fed Chair Jerome Powell’s speech is the main event. Last year, he dropped hints about rate cuts, inflation, and jobs, moving markets. This year, with a September rate cut expected, his words could shift rates again.

Powell’s 2024 Highlights:

- Policy: Ready to cut rates, but timing depends on data.

- Inflation: Confident it’s heading toward 2%.

- Jobs: No major inflation risk from the labor market, but cooling is possible.

- Risks: Less worry about inflation, more about job market slowdown.

- Focus: Support jobs while keeping prices stable.

Mortgage Market Guide Candlestick Chart

The chart shows mortgage rates stuck in a range, with a ceiling (4.50%) capping drops and a floor (4.20%) limiting rises. A breakout is coming, which will signal the next move for mortgage and housing pros, as well as homebuyers and refinancers.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, August 15, 2025)

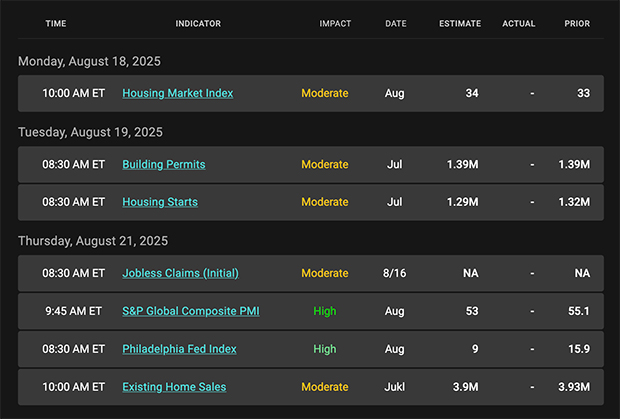

Economic Calendar for the Week of August 18-22

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.