This past week, interest rates touched the lowest levels of the year. Let’s break down what happened and preview what’s ahead.

“Well, It’s Safe to Dance, It’s a Safety Dance” – “The Safety Dance” by Men Without Hats.

What is a safe haven trade?

A safe haven trade occurs when investors seek low-risk assets during times of market uncertainty or economic instability, such as financial crises or geopolitical tensions. For bonds, this typically means a shift toward government bonds, like U.S. Treasury bonds, which are viewed as safe due to their low risk of default. When investors rush to buy these bonds, demand increases, pushing bond prices higher.

Since bond prices and yields have an inverse relationship, this surge in demand causes yields-which represent the effective interest rate on the bonds-to decrease. As a result, interest rates tied to these bonds, such as the benchmark 10-year Treasury yield, tend to fall during safe haven trades. This flight to safety reflects investors’ preference for stability over riskier investments like stocks.

Stocks have been under selling pressure for the month of March, and bonds/rates have been the beneficiaries. Oddly enough, March was the first month in five years where stocks went down and rates went down.

A Billion a Day

Another big event took place last week, which helped bonds and rates. At the recent Fed meeting, Fed Chair Jerome Powell announced that the Fed would pause Quantitative Tightening as of April 1st.

What does that mean?

Pausing QT is like the Fed saying, “Let’s stop selling bonds for now and just keep what we have.” By holding onto its stash of Treasuries, the Fed keeps demand steady.

This helps prevent bond prices from falling too much, which in turn keeps Treasury rates from spiking. Lower or stable rates make borrowing cheaper for the government (and often for people too), giving the economy a bit of breathing room.

So, pausing QT acts like a brake on rising rates, keeping things calmer in the bond market!

That certainly worked this past week amidst the elevated uncertainty.

Labor Market Still Healthy

The ADP payroll report, a reading on private-sector jobs growth, for March was reported above expectations. This was a nice surprise, which normally would hurt rates. But the aforementioned QT pause and safety trade provided too much buying pressure, limiting any rise in rates.

30-Year Mortgage Rates:

The 30-year fixed rate mortgage averaged 6.64% as of April 3, 2025 down slightly from the previous week when it averaged 6.65%.

4.20% Falls

The 10-year Treasury note, a key driver of mortgage rates, had struggled to break below its 4.20% yield support level for nearly six months. That changed this past week as the 10-year closed beneath 4.20% for two consecutive days for the first time since early October. This could very well mean that 4.20% could become a ceiling of yield resistance-limiting rates from moving above that level.

Bottom Line: The bond market has been the beneficiary of uncertainty, along with the Fed pausing QT. If uncertainty continues, it could lead to even lower rates.

Looking Ahead

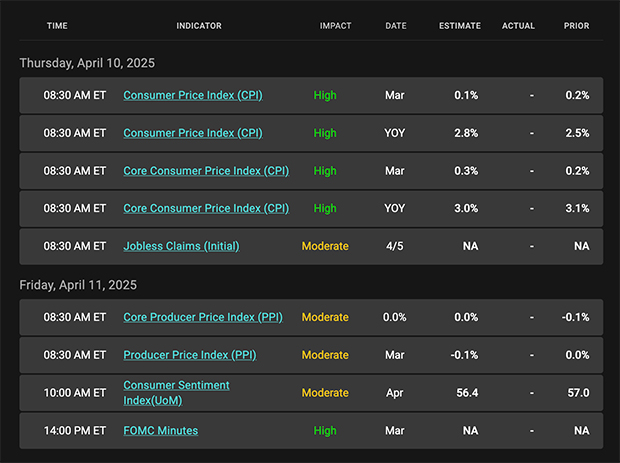

Next week, we are going to get the latest consumer inflation readings by way of the Consumer Price Index (CPI). This report is one of the biggest interest rate-moving reports, so markets will be watching that reading closely.

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are paramount-and they’re tied to mortgage bond prices. The chart below shows a view of the Fannie Mae 30-year 5.5% coupon. The rule is simple: rising bond prices mean falling mortgage rates; falling prices mean rising rates. Recently, prices pulled back from resistance at $100 as the 10-year Treasury yield climbed above 4.20%.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, April 4, 2025)

Economic Calendar for the Week of April 7 – 11

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.