Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

Rates Steady

This past week, interest rates pulled back a bit from the best levels in over three months. Let’s discuss what happened and look into the week ahead.

“Yeah, runnin’ down a dream that never would come to me” Runnin’ Down a Dream by Tom Petty

Fed Minutes Revealed

Three weeks after every Fed meeting, the minutes from those meetings are released, providing greater detail and insight into what Fed members were thinking about inflation, the economy, and rates as they decided on monetary policy, including what to do with interest rates.

The Federal Reserve released the minutes from its June 17–18, 2025, meeting last Wednesday, offering insights into the committee’s deliberations. The Federal Open Market Committee (FOMC) decided to maintain the federal funds rate at the current target range of 4.25% to 4.50%, reflecting a consensus that this stance remains appropriate given the economic outlook.

Fed officials noted a solid pace of economic activity and a low unemployment rate, though they acknowledged that uncertainty about the outlook, largely tied to trade policy and tariffs, has diminished but remains elevated.

The minutes highlighted concerns about persistent inflation risks, with several members pointing to potential long-term effects from tariffs, while others observed a possible gradual softening in labor market conditions and slower economic growth ahead.

There was little support for an immediate rate cut, with most participants viewing the current policy as well-positioned to address emerging risks, though a couple expressed openness to a reduction at the July 30 meeting if data warranted it.

What’s in it for us? These minutes suggest a cautious yet stable outlook on the overall economy. The lack of consensus on rate cuts, with some participants seeing no reductions in 2025 and others anticipating a gradual easing, implies that any policy shift will depend heavily on incoming data, particularly on inflation and employment.

The focus on tariff impacts could lead to increased scrutiny of trade-related economic indicators, potentially influencing bond yields and equity valuations if inflationary pressures increase; something that has not happened yet.

After these minutes were released, the chance of a rate cut in July remained off the table, with a cut in September sitting at just a 65% probability.

FICO/VantageScore – Good News for Housing

This past Tuesday, a significant development in the mortgage industry unfolded as the Federal Housing Finance Agency (FHFA), led by Director William J. Pulte, announced that mortgage lenders can now use VantageScore 4.0, a credit scoring model developed by the three major credit bureaus (Equifax, Experian, and TransUnion), as an alternative to the long-dominant FICO score for underwriting government-backed loans through Fannie Mae and Freddie Mac.

This move, effective immediately, aims to increase competition in the credit score ecosystem and aligns with President Trump’s mandate to lower costs, potentially reducing fees associated with credit checks. While FICO shares plummeted over 17% due to fears of losing market dominance, the decision allows lenders to maintain tri-merge credit checks (using all three bureaus) without requiring new infrastructure, offering flexibility while challenging FICO’s historical monopoly.

This development benefits prospective homebuyers by expanding access to mortgage opportunities, particularly for those with limited or non-traditional credit histories. VantageScore 4.0 is designed to be more inclusive, factoring in alternative data like rent payments reported to credit bureaus, which could help “forgotten Americans” qualify who might have been excluded under stricter FICO models.

By potentially lowering the cost of credit assessments and broadening eligibility, this shift could ease the path to homeownership, especially for first-time buyers or those with thin credit files, though the extent of cost savings passed on to consumers remains uncertain as lenders adapt to the new option.

30-Year Mortgage Rates

The 30-year averaged 6.72% as of July 10, 2025, up from the previous week when it averaged 6.67%.

4.20% to 4.50%

The 10-year Treasury note yield, which closely correlates with mortgage rates, traded at a critical level of 4.20% before backing away to its current 4.35%; essentially keeping yields in the range they have been in since October, between 4.20% and 4.50%.

Whichever way yields break out of this range will likely determine the next directional move for interest rates overall. If the 10-year yield moves below 4.20%, yields are likely moving another leg lower. On the other hand, should yields push above 4.50%, rates are likely moving higher.

Looking Ahead

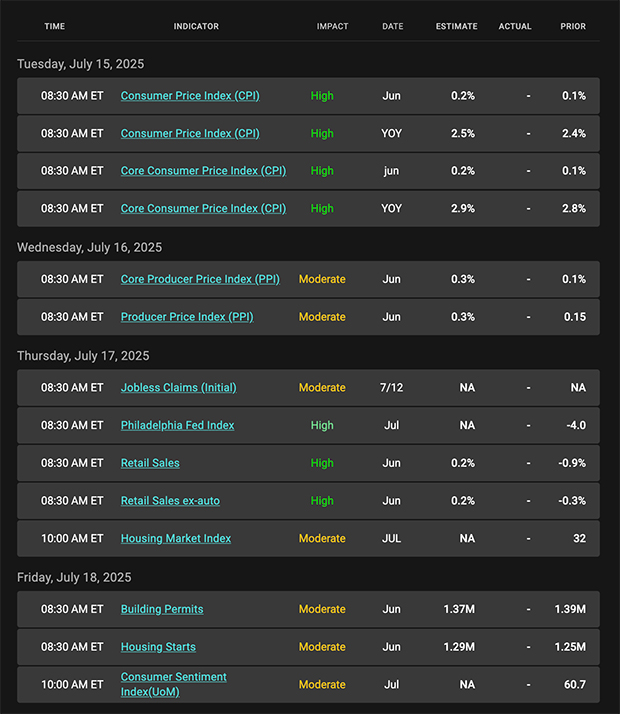

Next week, the economic calendar heats up with several high-impact reports for the financial markets to sift through. Leading the way will be the Consumer Price Index (CPI), an important measure of consumer inflation. As noted above, attention will focus on whether tariffs have led to an uptick in prices; this has not transpired as of now.

There will also be housing readings and consumer sentiment numbers to round out the week.

Tariff and trade deal uncertainty remains high as tariffs begin to be implemented.

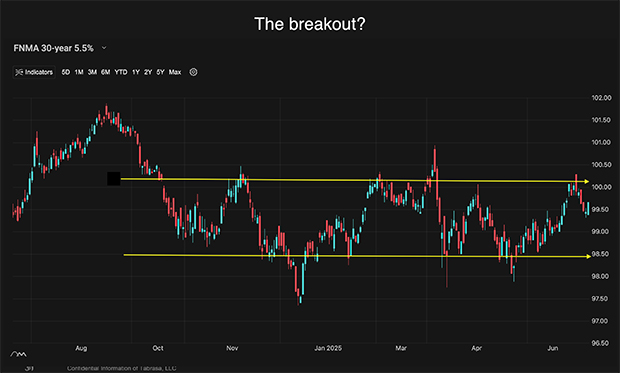

Mortgage Market Guide Candlestick Chart

The chart clearly shows how prices remain in a wide range, with a ceiling limiting price/rate improvement and a floor limiting price/rate worsening. At some point, bonds will break out of this longstanding range, and when they do, it will be a clear signal for mortgage and housing professionals and those looking to purchase or refinance a home.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, July 11, 2025)

Economic Calendar for the Week of July 14 – 18

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.