This past week interest rates improved to the best levels since mid-December. Let’s look at what happened and prepare for the week ahead.

I’m pickin’ up good vibrations, she’s giving me excitations (oom bop bop)…Good Vibrations by The Beach Boys.

Treasury Secretary Scott Bessent

In his first interview since becoming Treasury Secretary, Scott Bessent said he is focused on lowering the 10-year Note yield and not on the Fed lowering the Fed Funds Rate. This news is important to mortgage and housing because the yield on the 10-year Note ebbs and flows with 30-year mortgage rates.

Mr. Bessent talked about the need to lower inflation and focus on expanding the supply of energy.

“For hard working people the energy component for them is one of the surest indicators for long-term inflation expectations. So, if we can get gasoline back down, heating oil back down, then those consumers will not only be saving money, but their optimism for the future will help them rebuild from recent years of high inflation”.

He went on to say – “If energy prices are brought down, tax-cut extensions are enacted, and the economy is deregulated, then rates will take care of themselves.”

This news was a reminder that the Fed doesn’t control mortgage or long-term rates. Those rates respond to the economy, inflation, and inflation expectations, which are more influenced by fiscal policy, originating from the Administration and Congress.

Lower Yields Abroad Equals Lower Rates in the U.S.

Our rates also received some relief from news that the United Kingdom showed some of the best bond auctions in years. Their government bonds, called Gilts, have seen their rates spike higher in recent months due to excessive debt. Well, this past week, the Gilts auctions saw tremendous buying appetite, which helped lower their yields and thereby pressure yields lower around the globe. This appears to be another case where the cure for higher rates was higher rates. At some point, yields climb higher to a level that is attractive to investors, and that just happened.

Oil Slides Lower

As mentioned earlier, Treasury Secretary Bessent is focused on lowering energy prices as they are a key component of inflation. The good news here is that since January 15th, when oil touched just over $80 a barrel, oil prices have slid lower and now hover just over $71 a barrel. If oil continues to move lower, it will be disinflationary and help lower inflation expectations in the future. This would likely cause the 10-year Note yield to decline and bring mortgage rates down as well. The opposite is true.

30-year Mortgage Rates

The 30-year fixed rate mortgage averaged 6.89% as of February 6, 2025, down from the previous week when it averaged 6.95%. A year ago at this time it was 6.64%.

10-year Note 4.50%

The 10-year Note yield, which ebbs and flows with mortgage rates, declined nicely from the 2024 highs above 4.80% and moved beneath important yield support at 4.50%. If the 10-year Note can remain beneath 4.50% for a couple of days, that level would become a ceiling of yield resistance, limiting rates from climbing higher and resulting in a welcome development.

Bottom Line: Much like the previous two times rates were at these levels, we are seeing rates retreat lower once again. With the 10-year Note beneath 4.50%, the yield could very well slide lower to test the 4.20% level.

Looking Ahead

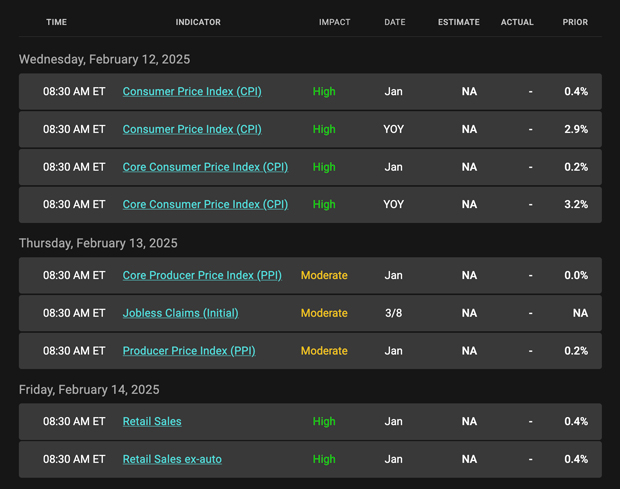

Next week brings important inflation readings as both the Consumer Price Index (CPI) and Producer Price Index (PPI) will be released. The former could be a bigger market mover as it is a reading on consumer inflation or prices. PPI is also important because it shows the pace of inflation at the producer or wholesale level, making it a leading indicator of future inflation. Mixed in with these important reports will be the Treasury selling $125 billion worth of new Treasury debt.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices have climbed higher and standing at the best levels since mid-December, meaning the lowest mortgage rates since that time.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, February 7, 2025)

Economic Calendar for the Week of February 10 – 14

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.