Please note: While we live and breathe Non-QM, we know the bigger picture matters. This update looks at the broader mortgage market because what’s happening out there impacts everyone—borrowers, brokers, and lenders alike.

Markets improved for the fourth consecutive week, stabilizing after a turbulent April. Let’s recap last week’s key developments and preview what’s on the horizon.

GDP Headline Shock

Last week, first-quarter gross domestic product (GDP) was reported, revealing a surprising -0.3% contraction, against expectations of 0.2% growth. This alarming headline initially dragged the stock market down, with the Dow plunging 900 points intraday. However, markets rebounded by day’s end. What caused this volatility?

Pre-Tariff Import Surge

Anticipation of impending tariffs led companies to import massive volumes of goods, ballooning the trade deficit to one of the widest in history. In GDP calculations, net exports are subtracted, and this unprecedented deficit slashed GDP by nearly 5 percentage points; the largest impact on record. Once this anomaly was understood, markets viewed the GDP decline as a one-off, expecting a rebound in the next quarter.

The Fed’s Preferred Inflation Metric: Core PCE

Among numerous inflation indicators, the Federal Reserve closely monitors core PCE, targeting a 2% annualized rate. This metric cooled further to 2.6% year-over-year, tying the lowest level in four years. Low inflation is favorable for bonds and interest rates, making this a positive signal for the bond market. Additionally, the report showed wages and consumer spending surpassing expectations while inflation eased; a promising sign for economic health if this trend persists.

Oil Prices Hit 4-Year Low

Oil prices, which peaked at $81 per barrel in mid-January, fell below $60 per barrel last week for the first time in four years. Lower oil prices reduce inflationary pressure, contributing to the ongoing decline in interest rates.

Pending Home Sales Soar

Pending Home Sales, a leading indicator based on contract signings, surged well above expectations, marking the strongest reading since December 2023. NAR Chief Economist Lawrence Yun noted, “Home buyers remain highly sensitive to even slight changes in mortgage rates. The robust increase in contract signings signals a growing pool of potential buyers, driven by steady job growth.”

30-Year Mortgage Rate

The 30-year fixed rate mortgage averaged 6.76% as of May 1, 2025, down from the previous week when it averaged 6.81%.

4.20%

The 10-year Treasury Note, a key driver of mortgage rates, briefly hit 4.60% on April 11th but has since fallen below 4.20%. If the 10-year Note remains under this critical technical level, it could act as a ceiling, limiting further rate increases.

Bottom Line: April was a rollercoaster, but stocks and bonds ended on a high note, with interest rates declining for four weeks straight. The coming week, dominated by the Federal Reserve meeting, will be pivotal.

Looking Ahead

The Federal Reserve meeting is the week’s main event. While a rate cut is unlikely, speculation is growing that the Fed may signal a potential cut in June, with markets pricing in a 65% probability. Upcoming Treasury auctions could also influence bond prices and rates. On the equity front, the adage “Sell in May and Go Away” looms large amid persistent market volatility; something to monitor closely.

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are critical and closely tied to mortgage bond prices. The chart below tracks the Fannie Mae 30-year 6.0% coupon. The rule is straightforward: rising bond prices lead to lower mortgage rates, while falling prices drive rates higher. Recently, bond prices have climbed from their lows, supported by reassuring comments from Jamie Dimon, Scott Bessent, and the Fed, alongside declining oil prices and inflation readings.

Chart: Fannie Mae 30-Year 6% Coupon (Friday, May 2, 2025)

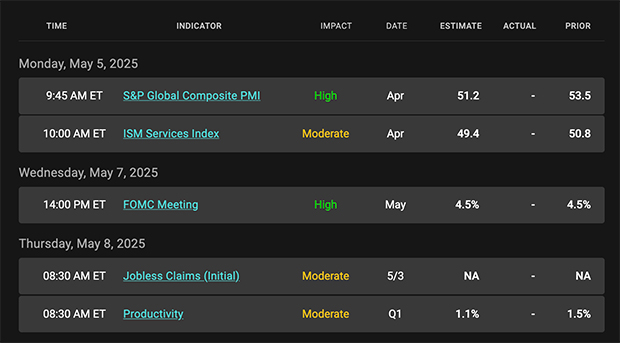

Economic Calendar for the Week of May 5-9

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.