This past week, mortgage rates continued their recent decline, reaching their lowest levels in four months. Let’s break down what happened and preview the week ahead.

“Lord, I’m Coming Home to You” – Sweet Home Alabama by Lynyrd Skynyrd.

The Bessent Bond Rally

A couple of weeks ago, Treasury Secretary Scott Bessent targeted the 10-year Treasury Note yield, pledging measures to push this key interest rate lower. The 10-year Note closely influences 30-year mortgage rates, so a drop in its yield is critical for reducing borrowing costs. And drop it has; over the past two weeks, the 10-year Note yield fell from 4.62% to 4.25%, driving mortgage rates down alongside it.

Trends Are Our Friends

Looking back to mid-January, both oil prices and the 10-year Note yield peaked. Oil hit $80 per barrel then slid to $68…a $12 drop. This decline acts as a disinflationary force, which is good news for interest rates across the economy. Let’s hope these friendly trends continue.

It’s More Than Inflation

What’s impressive about this rate improvement is that it followed a higher-than-expected Consumer Price Index (CPI) report just weeks ago. This shows markets are forward-looking, caring more about where inflation is headed than where it’s been. February’s sharp drop in oil prices should set the stage for favorable headline inflation numbers next month.

Bonds Thrive on Chaos and Uncertainty

Uncertainty around global growth and potential tariffs has also boosted bonds. It’s unclear if tariffs will happen, when they might start, or how inflationary they’d be. In response, investors have flocked to safe assets like U.S. Treasuries and the dollar, pulling back from stocks and cryptocurrencies.

The 4.25% Level

The 10-year Note’s decline to 4.25% is significant because this yield acts as a key support floor. It could halt or even reverse the decline in interest rates. Keep an eye on this level with us.

30-year Mortgage Rates

The 30-year fixed rate mortgage averaged 6.76% as of February 27, 2025, down from the previous week when it averaged 6.85%.

Bottom Line: Interest rates have been falling since Secretary Bessent focused on lowering the 10-year yield. However, declines like we’ve seen won’t be smooth; expect disruptions, especially with bonds now at critical levels.

Looking Ahead

Next week, attention shifts to the employment side of the Federal Reserve’s dual mandate. We’ll get data on job openings, quit and hire ratios, and the all-important jobs report on Friday. Current expectations are for 155,000 new jobs

Mortgage Market Guide Candlestick Chart

Mortgage bond prices dictate home loan rates. The chart below shows a one-year view of the Fannie Mae 30-year 6% coupon. As prices rise, rates fall and vice versa. On the right side of the chart, you can see prices climbing steadily, now at their highest since October, translating to the lowest mortgage rates since then.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, February 28, 2025)

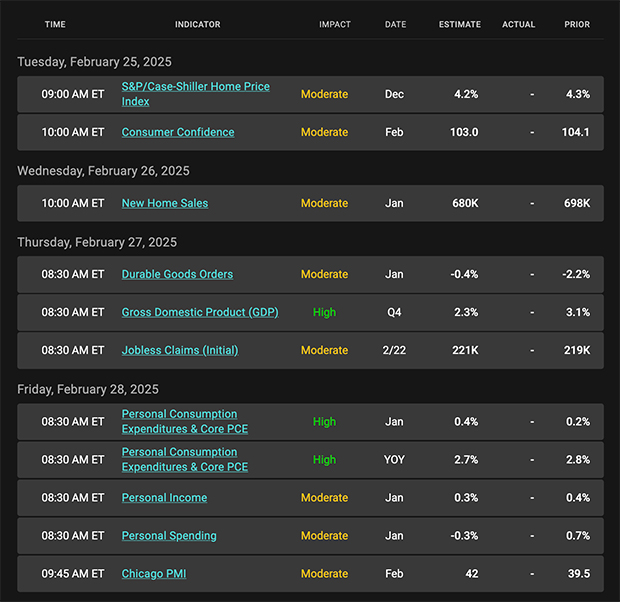

Economic Calendar for the Week of March 3 – 7

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.